FAQ

FAQ (General Section)

Q1) How is FullChequeProperty.com different than other real estate agents/realtors/property dealers?

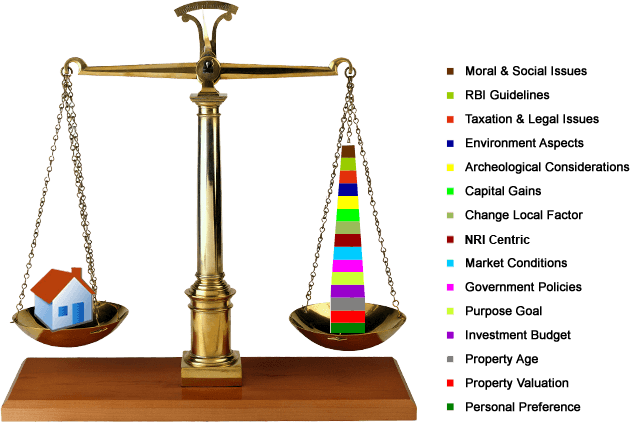

Fig.(Multi-Criteria Property Solutions) highlights our strengths. Besides, all property transactions channelized through us display total transparency and we prefer that full or the bulk of payments are primarily made through Cheque or White Money. Cash transactions, if any, are fully accounted for. Besides you shall be dealing with well educated, honest, knowledgeable and sensitive professionals.

Q2) How does FullChequeProperty.com work towards ‘exceeding customer expectations’?

We provide optimised solutions Fig.. We BUY SELL a property by adopting a holistic approach. Moral values like honesty, sensitivity and compassion are given due importance along with the commercial aspects like capital gains, taxation, property valuations, environmental aspects, government policies, property age etc. As a result the client experiences a hassle free and satisfying property transaction process with a 360 degree solution.

Q3) Who can be our client?

All persons in India or abroad, who subscribe to the philosophy mentioned above, are welcome to be our prospective clients and can BUY SELL property in the Delhi region through us.

Q4) What is our ‘privacy policy’?

We maintain total confidentiality of all our prospective clients. This is irrespective of the property transaction materializing through us or not.

Q5) What is our ‘niche’ area in the real estate field?

We primarily deal in residential and commercial properties located in Delhi, Faridabad, Gurugram(Gurgaon), Noida, Greater Noida and Ghaziabad. The total property value may range from Rs.30 lacs to 100 crores or more. You can BUY SELL Plots, Bungalows (demolishable as well as ‘ready- to-move-in'), Floors, Flats, Shops, Offices, commercial complexes etc through us. As stated above we are pioneers of the concept of Full Cheque Property. The concept has a strong and honest footing whereby full payment through cheque mode(White Money) is preferred and encouraged.

Q6) What are the charges for the services provided by us?

Buying or selling a property through us would normally attract a nominal commission/charges of 1 to 2% of the total property value plus applicable Goods & Service Tax(GST) at actuals as per the Indian Tax laws. In some cases, there may be a need for an in-depth due diligence of the property. This may attract an additional but pre-defined cost structure. The full cost structure shall be disclosed in our initial quote itself.

Q7) What are other probable charges to be kept in mind while buying or selling a property?

Lawyer’s charges, Renovation cost, Demolition charges, Structural engineer’s cost, Pending dues of the local bodies, Registration charges, Incidental charges, Chartered Accountant's Fee, etc are some of the other charges you may have to incur. You should plan your total investment budget accordingly.

FAQ (NRI Section)

Q1) Who can buy immovable property in India?

Under the General Permission provided by the RBI, NRI's and PIO's can buy immovable property in India. The general permission, however, covers only the purchase of residential and commercial property and is not available for purchase of agricultural land / plantation property / farm house in India.

Q2) Are any documents required to be filed with the Reserve Bank of India after the purchase?

No. An NRI / PIO who has purchased residential or commercial property under general permission, is not required to file any documents/reports with the Reserve Bank of India.

Q3) Can an NRI / PIO buy more than one residential or commercial property under the general permission?

There are no restrictions on the number of residential or commercial properties that an NRI /PIO can buy.

Q4) How can an NRI / PIO make payment for purchase of residential or commercial property in India?

Payment can be made by NRI / PIO out of :

(a) funds remitted to India through normal banking channels or

(b) funds held in NRE / FCNR (B) / NRO account maintained in India

(a) funds remitted to India through normal banking channels or

(b) funds held in NRE / FCNR (B) / NRO account maintained in India

Q5) Can an NRI / PIO repatriate the sale proceeds of immovable property held in India outside India?

In the event of sale of residential or commercial property (other than agricultural land / farm house / plantation property) in India by a NRI / PIO, the Authorised Dealer may allow repatriation of the sale proceeds outside India. However, the amount to be repatriated should not exceed the amount paid for acquisition of the immovable property in foreign exchange received through normal banking channels, or the amount paid out of funds held in FCNR/NRE account. In the case of residential property, the repatriation of sale proceeds is restricted to not more than two such properties. NRI/PIO are also allowed by the Authorised Dealers to repatriate an amount up to USD 1 million per financial year out of the balance in the NRO account / sale proceeds of assets by way of purchase / the assets in India acquired by him by way of inheritance / legacy. This is subject to production of documentary evidence in support of acquisition, inheritance or legacy of assets by the remitter, and a tax clearance / no objection certificate from the Income Tax Authority for the remittance. All remittances exceeding US $ 1,000,000 (US Dollar One million only) in any financial year (April-March) requires prior permission of the Reserve Bank of India.

Q6) Can an NRI/PIO repatriate all the proceeds in case the sale proceeds were deposited in the NRO account?

NRI/PIO may repatriate up to USD one million per financial year (April-March) from their NRO account which would also include the sale proceeds of immovable property. There is no lock in period for sale of immovable property and repatriation of sale proceeds outside India.

Q7) If the immovable property was acquired by way of gift by the NRI / PIO, can he repatriate abroad the funds from sale of such property?

The total sale proceeds of immovable property acquired by way of gift should be credited to NRO account only. From the balance in the NRO account, NRI/PIO may remit up to USD one million, per financial year, subject to the satisfaction of Authorised Dealer and payment of applicable taxes.

Q8) Can NRI / PIO rent out the residential / commercial property purchased out of foreign exchange / rupee funds?

Yes, NRI/PIO can rent out the property without the approval of the Reserve Bank. The rent received can be credited to NRO / NRE account or remitted abroad. Powers have been delegated to the Authorised Dealers to allow repatriation of current income like rent, dividend, pension, interest, etc. of NRIs / PIO who do not maintain an NRO account in India based on an appropriate certification by a Chartered Accountant, certifying that the amount proposed to be remitted is eligible for remittance and that applicable taxes have been paid / provided for.